“The Impact of Institutions on Innovation”

with Alexander Donges and Rui C. Silva, 2023, Management Science, 69(4), 1951–1974, link to Online Appendix, replication files, SSRN Version, MS Version

SSRN version is identical to MS version except for formatting and copy editing.

Inclusive institutions are a first-order determinant of innovation.

Featured Article (1-4 out of 30-35 articles per issue are featured articles)

Media: Management Science, VoxEU

Grants and stipends:

-Deloitte Institute for Innovation and Entrepreneurship research grant

-Deloitte Institute for Innovation and Entrepreneurship stipend

Abstract [Click Here]:

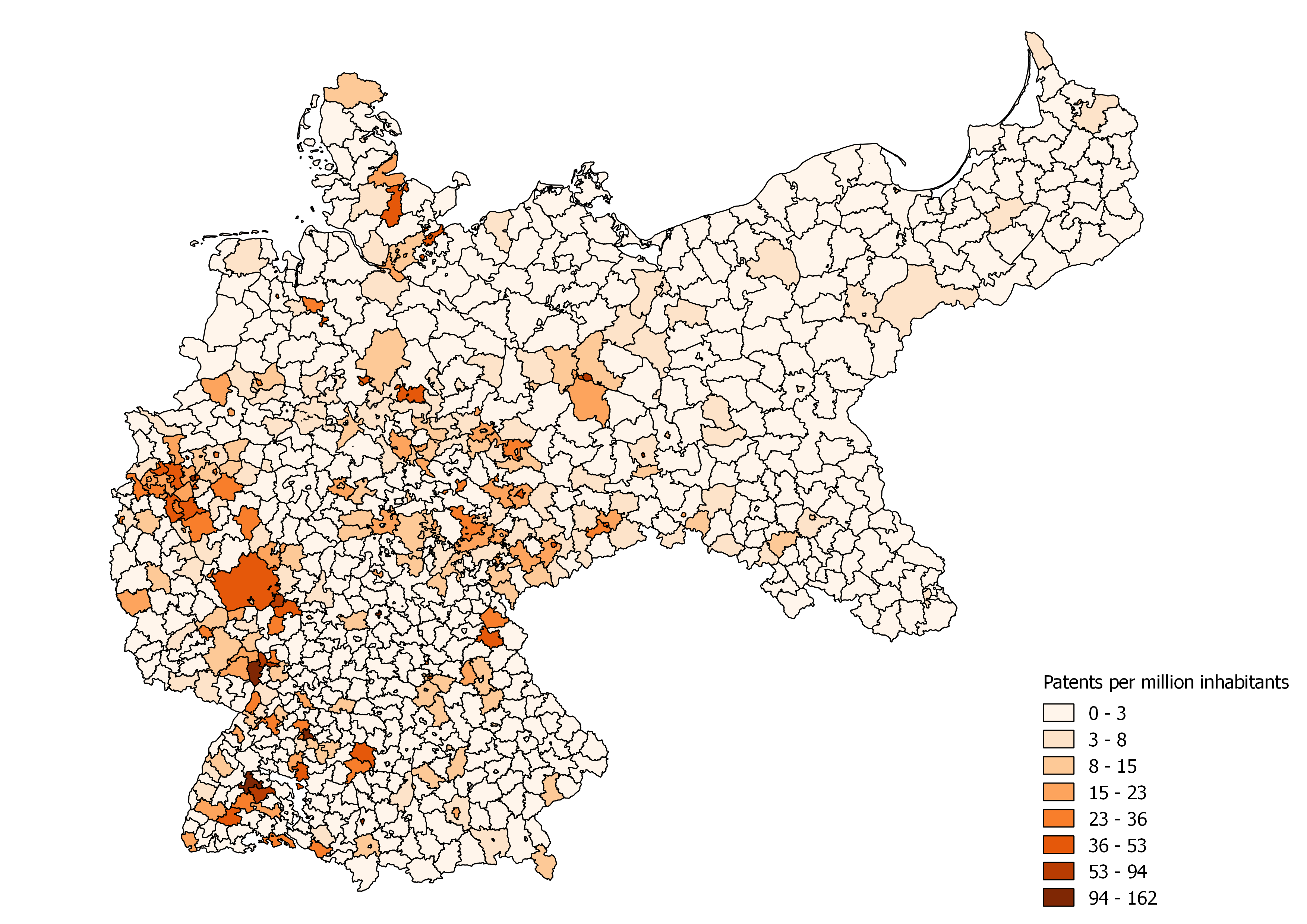

We study the impact of inclusive institutions on innovation using novel, hand-collected, county-level data for Imperial Germany. We use the timing and geography of the French occupation of different German regions after the French Revolution of 1789 as an instrument for institutional quality. We find that the number of patents per capita in counties with the longest occupation was more than double that in unoccupied counties. Among the institutional changes brought by the French, the introduction of the Code civil, ensuring equality before the law, and the promotion of commercial freedom through the abolition of guilds and trade licenses had a stronger effect on innovation than the abolition of serfdom, which increased labor market mobility, and agricultural reforms that broke up the power of rural elites. The effect of institutions on innovation is particularly pronounced for high-tech innovation, suggesting that innovation might be a key channel through which institutions ultimately affect economic growth. Our findings highlight inclusive institutions as a first order determinant of innovation.

“The Bright Side of Fire Sales”

with Henri Servaes, 2019, Review of Financial Studies, 32(11), 4228–4270, SSRN Version, RFS Version

SSRN version is identical to RFS version except for formatting and copy editing.

Fire sales are not as bad as widely thought since buyers gain substantially from them and the externalities of fire sales for other stakeholders are limited.

Abstract [Click Here]:

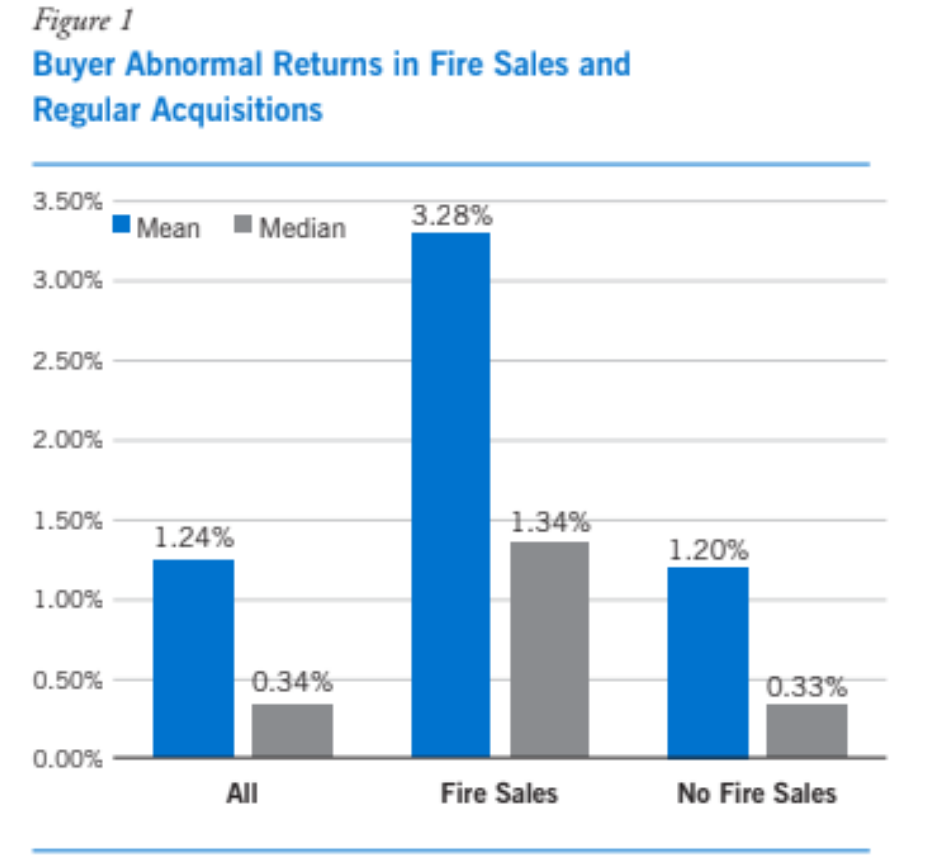

Firms that buy assets in fire sales earn excess returns that are two percentage points higher than in regular acquisitions. The mechanism behind this result is the reduced bargaining power of the seller. We find no difference in real effects or in the combined returns for buyers and sellers between fire sales and regular acquisitions, suggesting that the quality of the match is similar in both types of transactions. The externalities of fire sales for other stakeholders are limited. These results indicate that the welfare losses associated with fire sales are smaller than previously thought.

“The Benefits of Buying Distressed Assets”

with Henri Servaes, 2020, Journal of Applied Corporate Finance, 32(4), 105-116.

Working Papers

“Cross-Border Institutions and the Globalization of Innovation”

Strong cross-border institutions are an important driver of the globalization of innovation.

Conferences*: 25th Taiwan Symposium on Innovation Economics and Entrepreneurship, 3rd Junior Entrepreneurial Finance and Innovation Workshop, AEA, Cavalcade, China International Conference in Finance, EEA, EFA, FIRS, MFA, NFA, Pacific Northwest Finance Conference, Thirteenth Annual Northwestern/USPTO Conference on Innovation Economics.

Abstract [Click Here]:

We identify strong cross-border institutions as a driver for the globalization of innovation. Using 67 million patents from over 100 patent offices, we introduce novel measures of innovation diffusion and collaboration. Exploiting staggered bilateral investment treaties (BITs) as shocks to cross-border property rights and contract enforcement, we show that signatory countries increase technology adoption and sourcing from each other; they also increase R&D collaborations. Consistent with BITs reducing investment frictions, the results are particularly strong for process innovation and for countries with weak domestic institutions. Foreign investments with high frictions, such as inter-firm investments in R&D-active sectors, are most responsive to BITs.

“Tax Avoidance through Cross-Border Mergers and Acquisitions”

with Jake Smith, revise and resubmit, Journal of Accounting Research

Tax avoidance is a significant determinant of cross-border M&A.

Conferences*: 7th IWH-FIN-FIRE Workshop on “Challenges to Financial Stability”, AEA, Annual Meeting of the Swiss Society for Financial Market Research, Cavalcade, China International Conference in Finance, Edinburgh Corporate Finance Conference, EEA, EIASM Conference on Current Research in Taxation, Finance, FIRS, Organizations and Markets (FOM) Conference, National Tax Association, Journal of Law, Finance, and Accounting Conference, MFA, Paris December Finance Meeting, Seventh Annual M&A Research Centre Conference, ZEW Public Finance conference

Abstract [Click Here]:

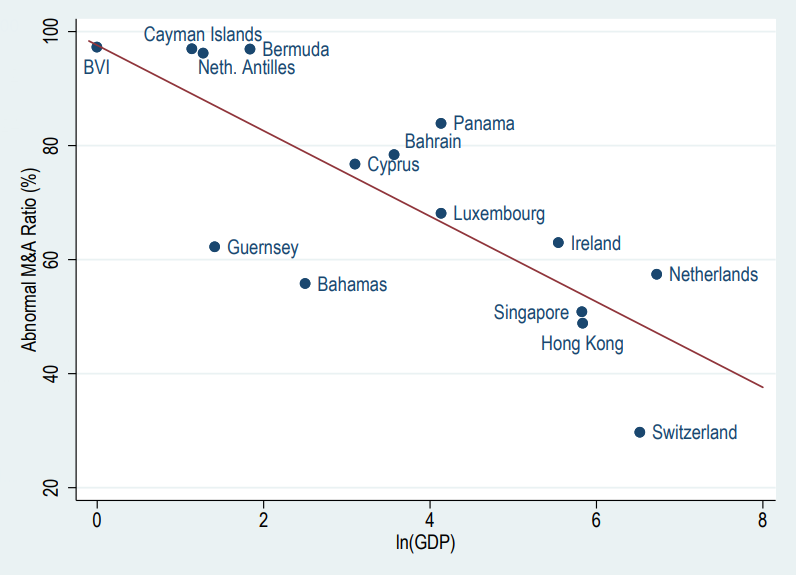

We provide the first comprehensive analysis of tax avoidance through cross-border, tax-haven mergers and acquisitions (M&A). Using novel tax residence data, we investigate 13,307 such transactions from 1990 to 2017, totaling $4.1 trillion in deal value, or 29% of cross-border M&A volume. $2.4 of the $4.1 trillion exceeds our prediction based on a gravity model with economic fundamentals. Small havens such as Bermuda alone make up $1.0 trillion or 8% of cross-border M&A volume. Tax haven M&A enables profit-shifting on intellectual property and the relocation of headquarters to havens, and results in $30.6 billion in recurring annual tax savings.

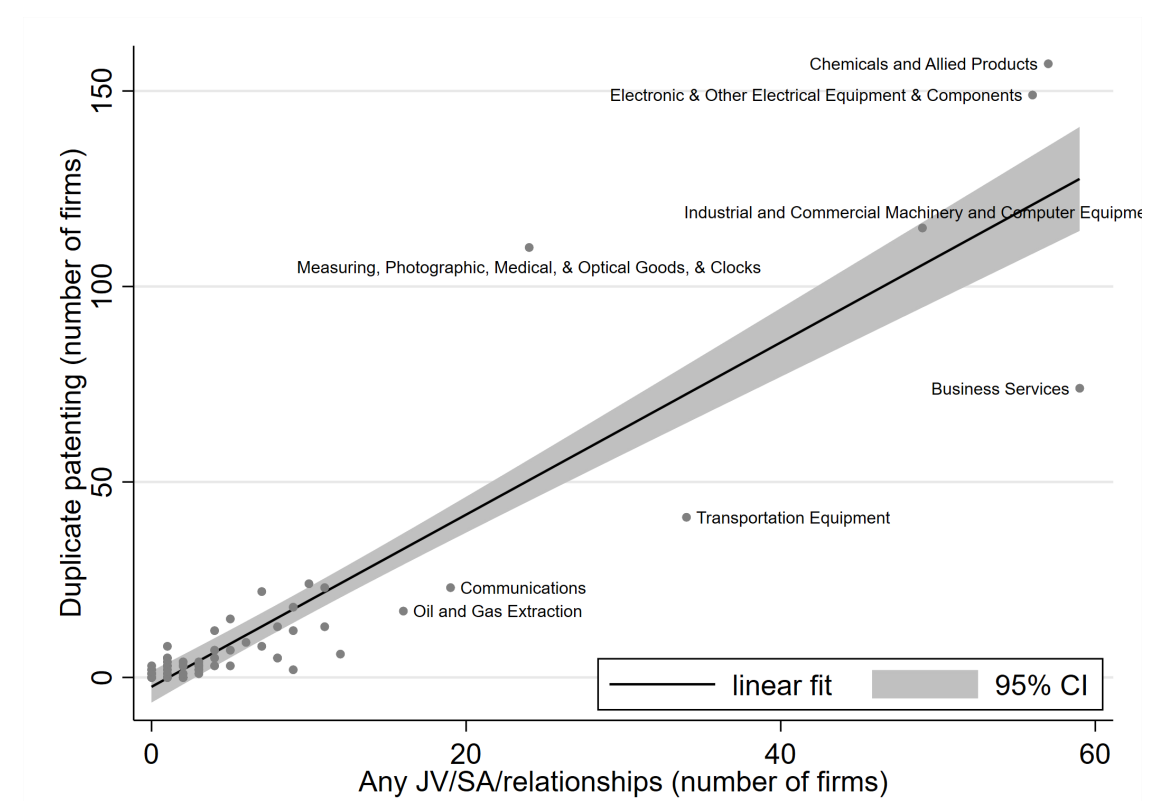

“Did Western CEO Incentives Contribute to China’s Technological Rise?”

with Bo Bian.

CEOs of Western firms with high-powered incentive contracts transfer more of their firms’ technologies to China than other CEOs, thereby contributing to China’s technological rise, while harming their firms in the long-run.

Media: Economics Podcast “The Week in Europe” by Klaus Adam and Dirk Schumacher. Listening options: Amazon Music, Apple Podcast, Soundcast, Spotify

Conferences*: 6th Erasmus Corporate Governance Conference, American Law and Economics Association “Junior Scholars Featured Papers Panel”, AFA, Annual Meeting of the Swiss Society for Financial Market Research, Cavalcade Asia-Pacific, CEPR Endless Summer Conference on Financial Intermediation and Corporate Finance, CEPR European Summer Symposium in Financial Markets, China International Conference in Finance, Conference on Financial Economics and Accounting, Finance, Organizations and Markets (FOM) Conference, FMA Napa/Sonoma Conference, GSU CEAR-Finance Conference on Technology, Innovation, and Corporate Finance, Junior Entrepreneurial Finance/Innovation Lunch Group, American Law and Economics Association “Junior Scholars Featured Papers Panel”, Lone Star Symposium, Mannheim Economics Alumni Symposium, MFA, Munich Summer Institute, NBER Chinese Economy, Northeastern University Finance Conference, Paris December Finance Meeting, RCFS Winter Conference, Workshop on Entrepreneurial Finance and Innovation

Abstract [Click Here]:

China’s quid-pro-quo policy requires foreign multinationals to trade off the short-term benefits of market access and the long-term costs of technology transfer. Do Western CEO incentives affect this trade-off? We document that firms managed by CEOs with high-powered incentive contracts form more partnerships with China and transfer more technology there. These firms subsequently lose R&D human capital to China and face more patenting competition from China, suggesting negative long-term consequences. We provide evidence consistent with the myopia-inducing property of high-powered CEO incentives. The paper highlights an important real effect of CEO incentives and a novel channel behind China’s technological catch-up.

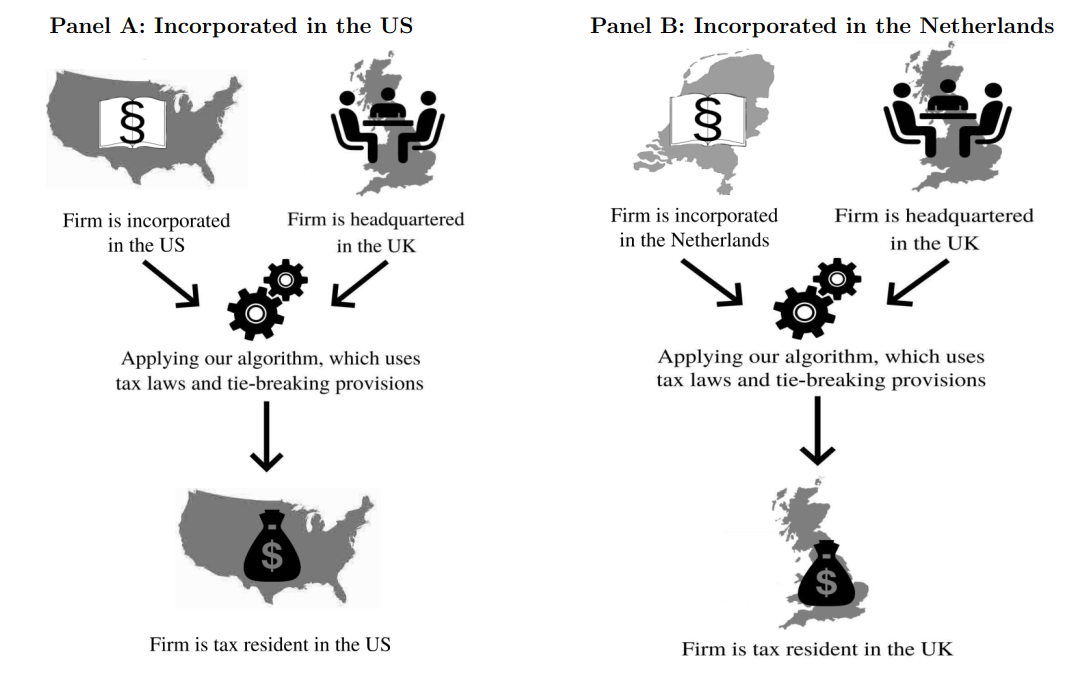

“Improving the Measurement of Tax Residence: Implications for Research on Corporate Taxation”

with Jake Smith.

We develop a tax residence algorithm and provide quantitative evidence on its importance in many frequently examined settings in corporate taxation.

Award: Best Paper in Corporate Finance at SFS Cavalcade North America 2023

Grants: International Tax Policy Forum

Conferences*: Annual Congress of the International Institute of Public Finance, Cavalcade, EIASM Conference on Current Research in Taxation, Finance, Organizations and Markets (FOM) Conference, Financial Markets and Corporate Governance Conference, National Tax Association Annual Conference

Abstract [Click Here]:

We propose an improved measurement of a key data item in corporate tax research, a firm’s tax residence. Prior research uses one of three proxies, which are in conflict with tax laws around the world. We use a novel algorithm that embeds the residency laws of 150 countries over 20 years to accurately assign tax residence and reassign a considerable fraction of firms relative to standard proxies. We provide evidence from two applications that reassignment significantly affects inferences. For instance, 20.7% of cross-border mergers and acquisitions involve an acquiror or target that is reassigned. Reassigned firms are systematically different from other firms along several dimensions, including effective tax rates.

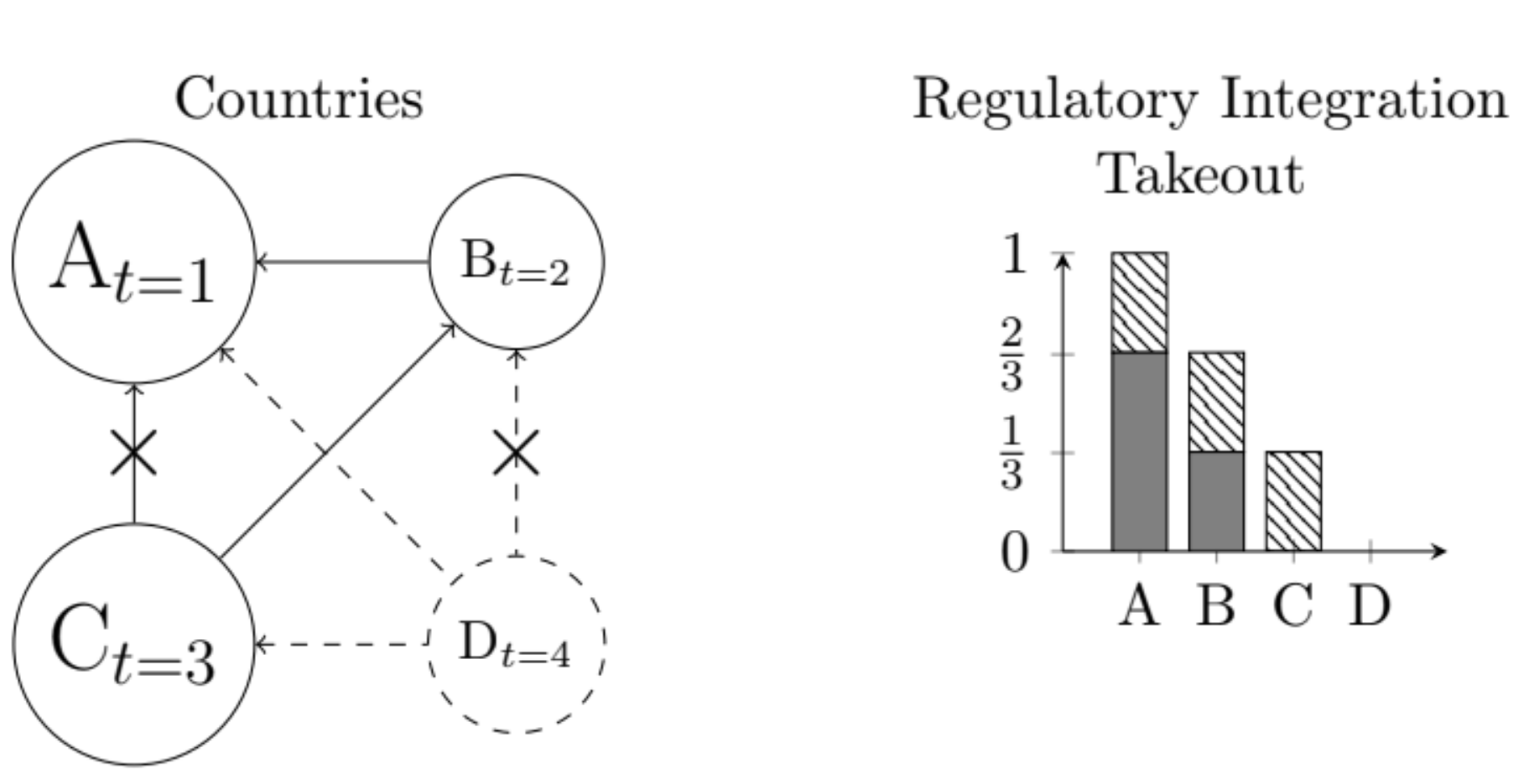

“Regulatory Integration of International Capital Markets”

Regulatory integration of international capital markets causes large increases in external financing, investment and employment.

Awards:

-Klaus Liebscher Award by the Austrian Central Bank

-Josseph de la Vega Prize (Special Mention) by the Federation of European Securities Exchanges

-European Central Bank’s Young Economist Award (Finalist)

-AQR Fellowship Award (Finalist)

Conferences*: Conference on “Banks, Systemic Risk, Measurement and Mitigation” (co-organised by RFS), Global Issues in Accounting Conference (organised by Chicago Booth), AEA, AFA, Barcelona GSE Summer Forum (Financial Intermediation and Risk workshop), Chicago Financial Institutions Conference, China International Conference in Finance, Christmas Meeting of German Economists Abroad, Conference on Capital Markets Union, European Winter Finance Summit, Federal Reserve Bank of Dallas Banking and Finance Workshop, MFA, NFA, North American Summer Meeting of the Econometric Society, 6th Financial Market Symposium, Public Authority and Finance: What is the Relevant Scale and Scope of Deregulation and Re-Regulation?.

Abstract [Click Here]:

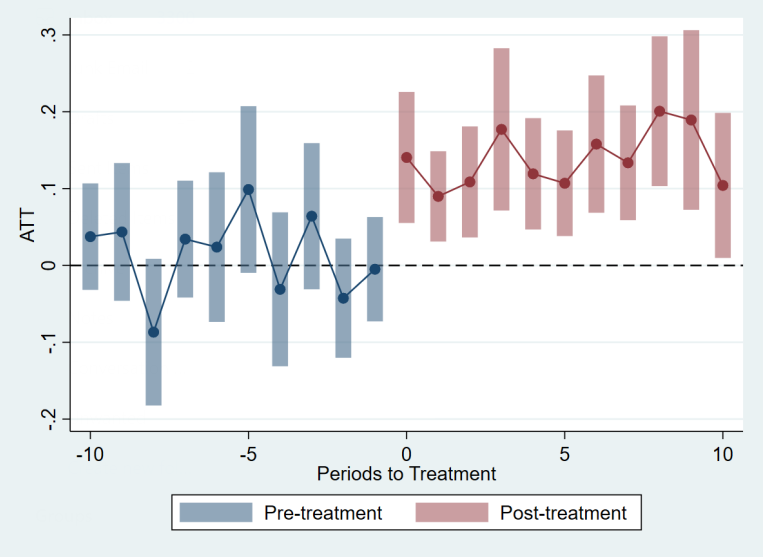

I examine the financial and real effects of regulatory integration of international capital markets using a unique policy plan by the European Union, which creates a common European market for financial services and capital, through, e.g., passporting rights. For identification, I exploit the bilateral and staggered nature of laws that are passed at the European level but are implemented by national governments. Over its implementation, regulatory integration leads to large increases in external financing, investment and employment for publicly listed firms. These results highlight the importance of regulatory integration of international capital markets for firms’ financing decisions and real outcomes.

“Do Consumers Care About ESG? Evidence from Barcode-Level Sales Data”

with Henri Servaes, Jiaying Wei and Steven Chong Xiao, CEPR Version, ECGI Version.

Using barcode-level sales data from retail stores, we show that environmental and social ratings are positively related to local sales, thereby highlighting the cash flow channel of ESG.

Awards:

-Finalist for the John L. Weinberg/IRRCi Best Paper Award

Media: ECGI Conversations (Video),Harvard Law School Forum on Corporate Governance, Knowledge at Wharton, Short Youtube video with Summary of Paper by London Business School, VoxEU

Conferences*: 4th Annual Boca-ECGI Corporate Finance and Governance Conference, Annual Convening of the Wharton ESG Initiative, China International Conference in Finance, Conference on Financial Economics and Accounting, Conference on CSR, the Economy, and Financial Markets, UT Dallas Ann & Jack Graves Foundation Conference, University of Delaware Weinberg Center/ECGI Corporate Governance Symposium, Drexel University Corporate Governance Conference, FIRS, MFA

Abstract [Click Here]:

Using granular barcode-level sales data from retail stores, we show that environmental and social

(E&S) ratings positively relate to local sales, especially in counties with more Democratic-leaning

and higher-income households. Higher ratings of a firm’s product market rivals negatively affect a

firm’s sales. Controlling for product-year-level heterogeneity, monthly product sales decline after

negative firm news on E&S issues. Finally, immediately after major natural and environmental

disasters, sales in counties close to the disasters become more sensitive to E&S ratings. Our study

provides direct evidence that E&S investments affect consumer demand–the cash flow channel of

ESG.

“The COVID-19 Bailouts”

Published as a pre-print in Covid Economics, Issue 83, 2 July 2021

with Jake Smith.

The COVID-19 bailouts are a windfall for many firms, and are expensive compared to past corporate income tax payments of the bailout firms.

First version: April 25, 2020

Conferences*: AEA

Abstract [Click Here]:

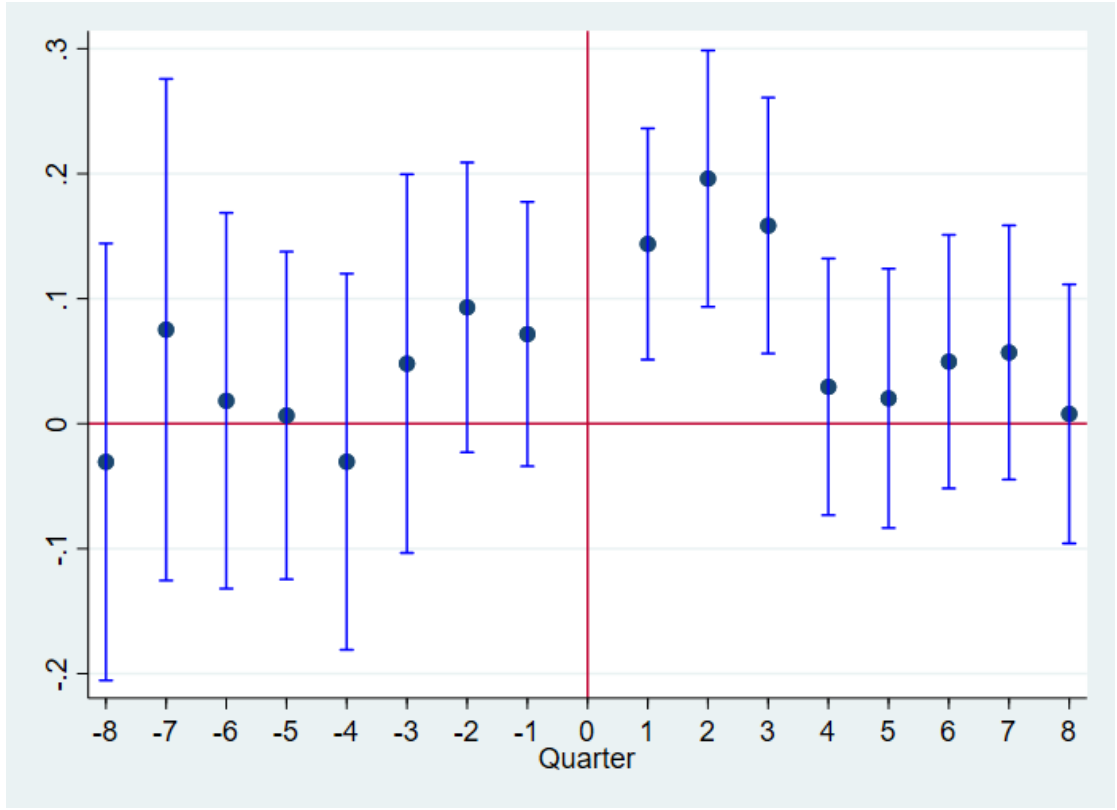

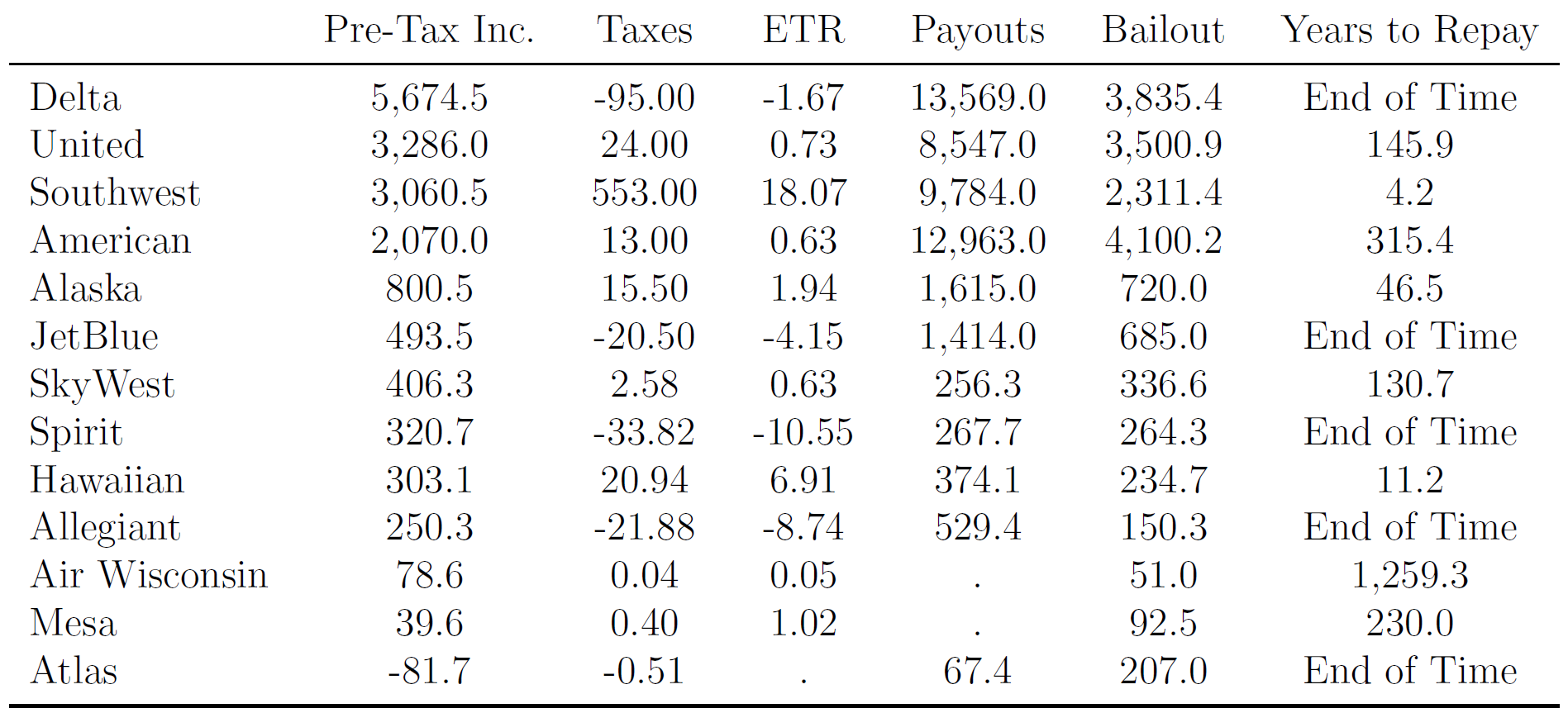

We use hand-collected data to investigate the COVID-19 bailouts for all publicly listed US firms. The median tax rate is 4% for bailout firms and 16% for no-bailout firms. The bailouts are expensive when compared to past corporate income tax payments of the bailout firms. We compute the number of years a bailout recipient has to pay corporate income tax to generate as much tax revenue as it received in bailouts: 135.0 years for the Paycheck Protection Program and 267.9 years for the airline bailouts. We also document a dark side of the bailouts. For many firms, the bailouts appear to be a windfall. Numerous bailout recipients made risky financial decisions, so bailing them out might induce moral hazard. Moreover, lobbying expenditures positively predict the bailout likelihood and amount.